Investing in Community Energy – puts your money where the power is!

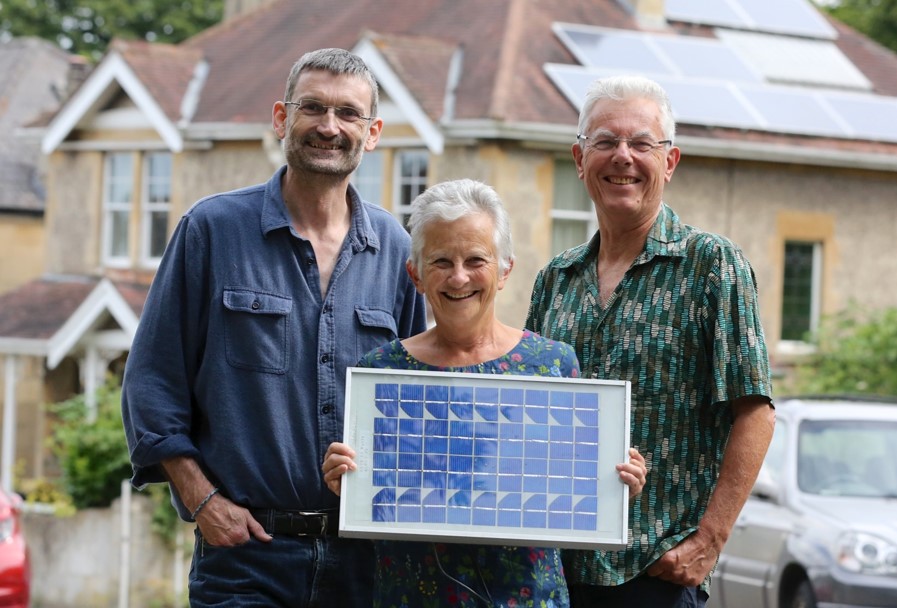

Community energy provides opportunities for people to become part of the practical solution to climate change.

Our recent Bond Offer to raise £1.2 million has received unprecedented support and has now closed after reaching target in just 1 month (75 days ahead of schedule).

With the proceeds of the recent bond offer we will install a further 1.2 MW of rooftop solar schemes across 7 more local schools and community sites, reducing carbon and delivering up to £65,000 per year in reduced fuel bills and additional community funds.

As a Community Benefit Society, BWCE is radically different from on ordinary company: we are required to prioritise benefit to the wider community. We pay interest on investors capital, but we do not distribute surpluses to investors.

We are proud of our track record

Our portfolio of 14.49 MW of community renewables is made up of 37 solar rooftop systems powering schools and community buildings, 5 ground mount solar arrays supplying low carbon energy to the grid and one small hydro scheme. We generate enough electricity to power the equivalent of 5000 homes and this has allowed us to donate £430,000 to our Community Fund which has awarded 111 grants supporting community action on carbon reduction and fuel poverty.

BWCE’s work and what happens to your investment

- Since 2010 we have been building renewable energy generating projects for the common good

- We are constantly looking for ways to reduce carbon emissions and reduce bills and we have run projects to explore how we better match renewables supply with local supply

- Over the past few years, we have been developing programmes to help local residents improve the energy efficiency of their homes and launched our Home Energy service in November 2023

- We have raised £23.5 million, £13.5 million in a series of community share and bond offers.

We are now one of the largest community energy businesses in the country!

However there is still so much more to be done. Watch this space as we will be re-opening our share offer in the coming months and inviting more people to invest and join BWCE.

Solar Roof Spotting

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu