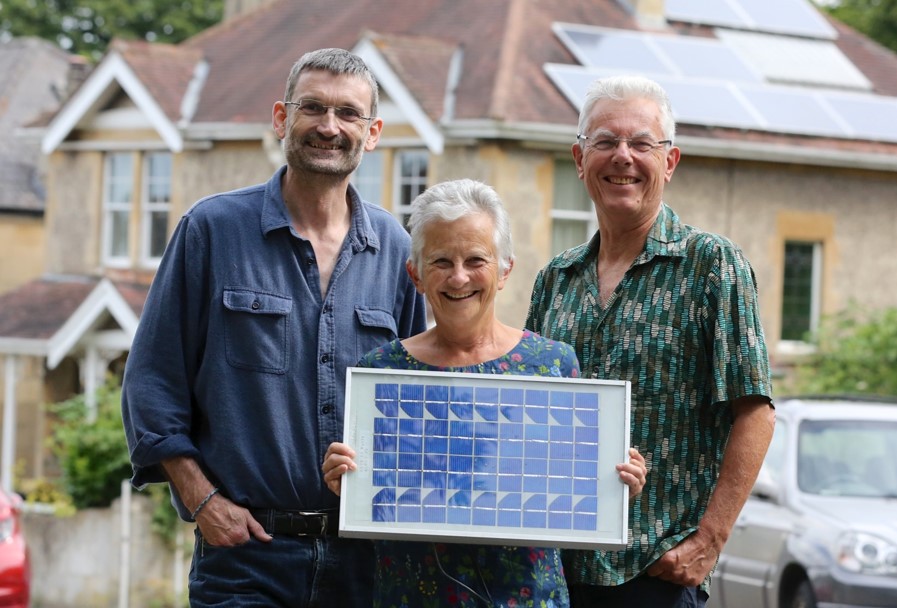

Bath & West Community Energy Fund (BWCE Fund) has awarded £40,500 in grants to reduce carbon emissions and tackle fuel poverty. This year, the fund is supporting 10 local charitable and community organisations in Bath and the surrounding areas.

For the eleventh year running BWCE has given its surplus income from renewable energy generation to the independently run BWCE Fund for the benefit of local communities. Quartet Community Foundation administers the grant programme on behalf of BWCE Fund.

The grants will be used by local charitable and community organisations on a range of important projects, intended to:

- Cut carbon emissions.

- Reduce energy bills and waste.

- Help with the cost of living crisis by tackling fuel poverty.

“Since 2015, The BWCE Fund grant programme has awarded 111 grants worth over £350,000 to a wide range of local community organisations, all doing great work, often in our most disadvantaged communities, helping vulnerable people and those that support them to save money and energy, whilst reducing environmental impact, against a backdrop of increasingly difficult economic and fund-raising conditions. The impact of this year’s programme will include increasing access to community meals and local food growing, enabling more cycling, getting energy efficiency advice to harder to reach clients and cutting the energy costs and carbon emissions of key community infrastructure organisations.”

Jane Wildblood, Chair of Trustees for the Bath & West Community Energy Fund

“Charities are increasingly feeling the ongoing impact of rising costs and rising demand. We’re delighted to continue to work with the BWCE Fund to award these grants to groups across the B&NES area. The increased support provided through the BWCE Fund enables these projects to protect the environment while enabling people to reduce their fuel bills and energy consumption in a low carbon way.”

Angela Emms, Philanthropy Manager at Quartet Community Foundation

Rob Lewis from Bath Community Kitchen, a grant recipient comments on the huge difference this makes:

“We are absolutely thrilled that the Bath & West Community Energy Fund has provided a grant of £4,800.00 toward the towards our weekly community meals at the Lighthouse Centre in Twerton. These meals have been running weekly since December 2023 and provide locals with a free three course meal in a warm and welcoming space. Twerton is one of the most deprived areas in B&NES and these meals help to combat food poverty whilst also strengthening community and reducing food waste by sourcing surplus ingredients from local shops. For more information please contact [email protected].”

The 10 projects offered funding:

£5,000 to Bath City Farm toward the cost of creating sheltered and secure cycle parking at the farm, promoting low-carbon active travel and reducing car travel.

£4,800 to Bath Community Kitchen toward the group’s weekly community meals at the Lighthouse Centre in Twerton, which are made using surplus food that would otherwise go to waste.

£4,300 to Bath Share & Repair to involve more people in reducing carbon, waste and landfill through external events and community engagement.

£2,100 to Corston Community Orchard toward a solar generator for use by the orchard and Grow Timsbury, partner groups who both have a strong focus on promoting sustainable low-carbon lifestyles.

£5,000 to High Littleton Scout Group to replace single-glazed windows with double-glazed units in the scout group’s hall which also hosts valuable community activities.

£5,000 to Oasis Hub, Bath to provide household audits for the group’s pantry members experiencing economic hardship. Identifying what energy-saving measures they could benefit from, providing energy-saving equipment, and running workshops about reducing energy use.

£2,044 to Percy Community Centre, Bath to purchase and install a Bike Repair Station, to be sited outside the Percy Community Centre as a way of encouraging low carbon active travel and reducing car journeys.

£2,260 to SWALLOW to create an accessible vegetable growing area reducing food miles and enabling greater access to gardening and fresh, organic food for the group’s members with learning disabilities.

£5,000 to The Hive Community Centre, Peasedown to install Cavity Wall Insulation at the Hive, a community venue that provides a Youth Hub a community Food Pantry and a community Fridge to assist those in food poverty.

£5,000 to Time Bank Plus, Twerton toward the cost of a project worker for the group’s ‘Borrow It’ Library of Things, who will be involved in updating and expanding the Library of Things to offer a more comprehensive range of resources and opportunities to local people on low incomes.