Invest Today!

Join us on our mission to support local communities and tackle the climate crisis.

We need to raise further community investment so we can install more solar rooftop systems across schools and other buildings in the Bath & West area’ helping them save money and reduce their environmental impact.

We welcome investments of anywhere from £100 – £100,000 with a maximum interest rate of 5% (subject to performance). We’re a democratically run Community Benefit Society. This means that all investors, individual or business, regardless of how much they invest, will also become voting members of BWCE with one member one vote.

As with all investments, capital is always at risk. Please read the share offer document in full before choosing to invest.

Find out more about BWCE’s work and what happens to your investment

What we've achieved

We are proud of BWCE’s achievements to date. We have developed a not-for-profit community energy model, built a range of community owned renewable energy projects, recycled £380,000 of surplus back into local community projects and provided fair rates of interest annually to our members.

Between January 2019 and December 2023, we:

-

- Raised just over £2 million and installed over 1.2MW of new rooftop solar on 13 schools and 2 leisure facilities reducing both carbon emissions and fuel bills.

- Developed an extensive pipeline of new community renewables projects to be built out over the next 12-18 months.

- Established a number of pilot projects around energy demand management and launched a new home energy efficiency programme (November 2023).

Help us achieve more

This share offer will help us to raise the capital necessary to expand even further our portfolio of rooftop solar schemes, helping us to do our bit to reduce our collective impact on the climate.

Community energy provides opportunities for people to become part of the practical solution to climate change.

Becoming a member of BWCE provide you with the opportunity to:

-

- Join a not-for-profit community enterprise committed to carbon reduction and delivering community benefit.

- Receive a target interest on your investment of 5% (subject to performance).

- Support us to grow and increase our impact.

- Demonstrate community support for the ambitious response to climate change and energy security we desperately need.

We are now one of the largest community energy businesses in the country but our impact is still far from being enough.

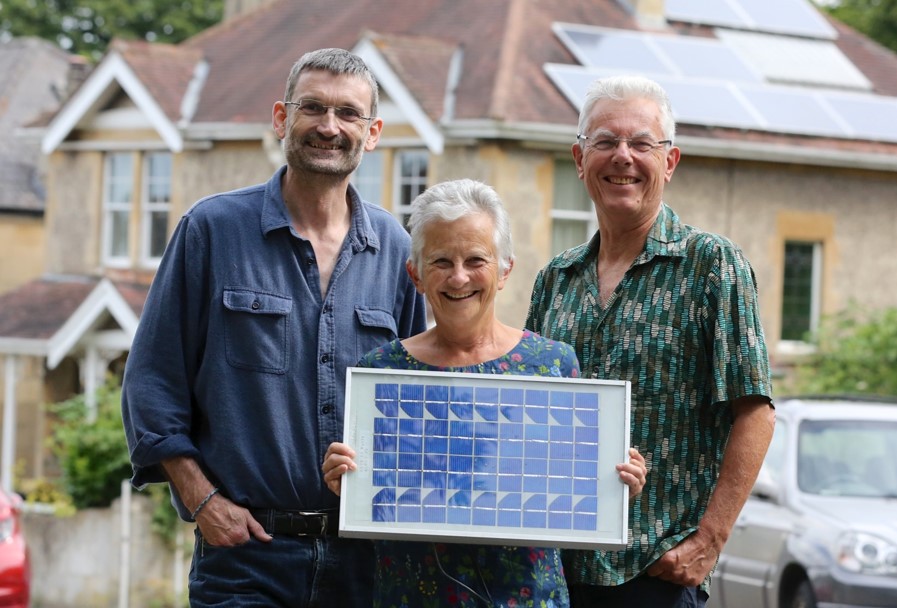

Solar Roof Spotting

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Share Offer Details

Apply at any time (shares allocated every two months)

- Open to new and existing members

- Minimum investment £100

- Target interest rate 5% (subject to performance)

- Interest accrues from the date of share allocation

- Next shares allocated in June 2024 – deadline 31st May 2024

In our previous share offer we raised £2,077,334 up to 31st December 2023. We now have a target to raise £800,000 by July 2024.

Funds Raised to date £107,600

Next Steps

To become a member of BWCE there are a number of ways to find out more and proceed:

Read more detailed information in our latest Share Offer document.

Review the questions previous investors have asked and our responses.

If you are ready to apply for shares online you can follow the link below to an online application form that allows you to read the share offer document, understand the risks involved and make an application. Shares can be paid for online by debit card or by bank transfer.

Risk Warning: Investing in BWCE puts your capital at risk. This means that you may lose some or all of the money that you invest. Read the full offer document, understand the risks and agree with the terms before investing.

Our share offer has received the Community Shares Standard Mark. This is awarded by the Community Shares Unit to offers that meet national standards of good practice. Follow the link below for more information.

Frequently Asked Questions

What type of organisation is BWCE?

Bath & West Community Energy is a Community Benefit Society. This means that:

- We are primarily for the benefit of the community at large, rather than just for our members. For more details see our Community Benefit page.

- We have democratic decision-making built into our structure.

- We can pay interest on members’ share capital but we cannot distribute surpluses to members in the form of dividends.

- We have an asset lock that protects the founding principles and ethos of the business.

For more information on Community Benefit Societies and how they differ from Cooperative Societies, another form of Industrial and Provident Society see here.

BWCE is registered with the Financial Conduct Authority (FCA). Our registration number is 30960R

Why should I become a member?

Become a member of BWCE and help us build our capacity to:

- Generate more renewable energy

- Develop new approaches to reducing carbon emissions

- Deliver community benefit

By becoming a member you will:

- Make a clear statement of support for what we are trying to achieve

- Help us to raise more funds for our work

- Become involved in a not-for-profit community enterprise, democratically run by its members based on one member one vote

- Earn a return of up to 5% per year on your investment depending on project performance

Who can become a member of BWCE?

Membership of BWCE is through shareholding with the following eligible to become a member.

- Individuals over the age of 16.

- For under 16s, shares can be held on their behalf and transferred to their ownership on their 16th birthday.

- Membership is also open to corporate bodies (e.g. charities, limited companies, co-operatives) and certain types of pension funds, such as Self Invested Personal Pensions (SIPPs).

How much do I need to invest and what are the returns?

Shares are valued at £1 each. The minimum shareholding is £100 and the maximum is £100,000, per member.

Shares are being offered with an annual target interest rate of 5%, subject to project performance. Interest rates will not exceed this target rate for these shares.

This share issue does not affect the terms of shares purchased before February 2019.

What will my investment support?

Through this share offer, we are seeking capital to enable us to complete the installation of nearly 800 kW of solar PV across 7 roofs, including 6 schools and to enable us to repay some existing investors. We also have a larger pipeline of solar PV projects coming through that we want to raise capital for.

How can I participate as a member?

You will be able to participate in decision making. As a member you will have one vote regardless of the number of shares you own. One Member – One Vote

You will be able to stand for election to BWCE’s board. If successful you will be able to hold the post for a period of three years before resigning or re-standing for election.

Membership is governed by our rules which are available to download here.

When are shares allocated?

Even though you can apply at any time, shares are allocated every two months in Feb, Apr, Jun, Aug, Oct and Dec and interest is accrued from the 1st of these months.

How is share interest calculated and when is it paid?

Members earn interest on the shares they own at a level that reflects the performance of BWCE’s projects. The interest is always paid annually and in arrears.

The process for deciding on, and paying, interest is as follows:

- The 31st of March is the financial year end for BWCE. After this point annual accounts are produced and then audited.

- BWCE’s board will then make a proposal for the level of interest to be paid to members based on the performance of BWCE’s projects in the previous financial year and BWCE’s financial position at the year end.

- Audited accounts and the board’s proposal for member interest payments are then presented at BWCE’s Annual General Meeting, usually in September, and voted on by the members.

- Assuming the relevant resolutions are passed by members, a statement of interest will be sent to each individual member and the payments can be made a short while afterwards.

What are the tax implications of BWCE Shares?

BWCE is required to send out share interest payments gross of tax (in other words with no tax deducted) and we are also required to provide to the Inland Revenue the names and addresses of shareholders who received share interest payments greater than £250. The interest should be declared on the tax return relating to the tax year you receive the actual money (NOT for the year in which it was earned by BWCE).

If in any doubt you must consult HMRC or your financial advisor.

Can I withdraw my shares when I want to?

Shares are withdrawable at the discretion of the BWCE board. Withdrawal requests are considered once a year (except in exceptional circumstances). All share withdrawal requests received by 1st July each year will be reviewed by the BWCE board at its first meeting following that date, usually in July or August.

Our policy on share withdrawal can be found here.

How else can I invest in BWCE?

Anyone over the age of 18 can invest in a BWCE bond offer when they are available. BWCE doesn’t have any open bond offers at the moment.

Bonds offer a fixed rate of interest, generally for a fixed term.

As a Bondholder you do not have the same rights as a member, being unable to participate in decision making and stand for the Board. However, we do try to involve Bondholders in the life of BWCE as much as possible.

We expect subsequent bond offers will be eligible for inclusion in the new Innovative Finance ISA (IFISA). This means investments made in this ‘wrapper’ will have their interest paid tax free.

Bond offers are issued as and when required. If you wish to be informed of the next bond offer please subscribe to our mailing list.